Velodyne's competitor Quanergy filed a patent challenge, US 7,969,558, in May this year, but the US Patent Trial and Appeal Board ruled that upheld the patentability of all the claims in Velodyne's groundbreaking US 7,969,558 patent. Then in August, Velodyne sued Chinese companies HESAI and Robosense with the same patent.

Only these three competitors are Velodyne's competitors?

Velodyne is currently a top lidar manufacturer. It was established in 1983 and was originally an audio device. Around 2006, founder David Hall developed a multi-beam rotating lidar sensor and became the darling of the market. This time point is far away Earlier than other lidar manufacturers, it established Velodyne's first-mover advantage, and its technology and mass production capabilities are in a leading position in the industry. Up to now, almost all self-driving car manufacturers will purchase their products. According to data, in 2017, more than 100,000 lidars were sold globally, with revenue reaching about 200 million US dollars. But automotive lidars are expected to generate only $2.5 billion in revenue by 2025, according to industry researcher IHS Markit. For Velodyne, it is natural to want to dominate the automotive lidar market, including the future 2.5 billion market, but will the market really be as severe as Velodyne thinks?

First of all, Velodyne's lidar products have not been mass-produced and have always been a pain point.

Secondly, in recent years, other later competitors have launched low-cost lidar solutions, quickly occupying the market with extremely low prices and extremely high cost performance, gaining the attention of some car companies, and gradually eroding Velodyne's market share, making its Facing more severe market competition. It includes lidar startups represented by Quanergy, IBEO, Innoviz, HESAI, Robosense, etc., as well as car companies represented by Waymo, Ford, BMW, Mercedes-Benz, etc., and even more so, Bosch, ZF, Farley Auto parts companies represented by Ao and others have also begun to actively deploy in the lidar industry, carried out cross-border cooperation, and launched a series of low-cost and cost-effective products.

Velodyne's competitors are far more than just three companies.

Why does Velodyne value US 7,969,558 so much?

It is understood that US 7,969,558 was applied by Velodyne founder David Hall in July 2007, and the patent title is High definition Lidar System, which was authorized by the US Patent Trial and Appeal Board (PTAB) in June 2011 . In addition, Velodyne has applied for 7 patent families of US 7,969,558 patents in the United States, Europe, China and the World Intellectual Property Organization.

This patent relates to a 3D point cloud measurement system based on lidar, which is regarded as the basic patent of 3D real-time surround view lidar and can be cited by a large number of patents. At present, the patent is mainly cited by lidar innovators, Tier 1 suppliers and vehicle manufacturers, such as Quanergy, BOSCH, BLICKFELD, LUMINAR, WAYMO, OUSTER, SAMSUNG ELECTRONICS, TOYOTA and China HESAI Technology. It is not difficult to see that the main focus of citing this patent is in the fields of autonomous driving, ADAS, and robot vision.

In fact, the patent is also applicable to other fields, such as drones, surveying and mapping, mobile robot 3D point cloud lidar and other fields. In the future digital world, the role of lidar as a sensor is self-evident. Autonomous driving, Internet of Things, industrial Internet, and smart home, which field can leave lidar? So now a large number of new lidars developed by start-ups are extending to multiple scenarios. But it also warns these manufacturers that avoiding patent infringement of US 7,969,558 is the key.

Under the protection of Velodyne patent, the battle of domestic lidar companies?

With the globalization of the market economy, it is already a must for enterprises to "go overseas". As for the current situation of China's lidar market, domestic lidar wants to "get better", and patents are "the threshold that cannot be bypassed".

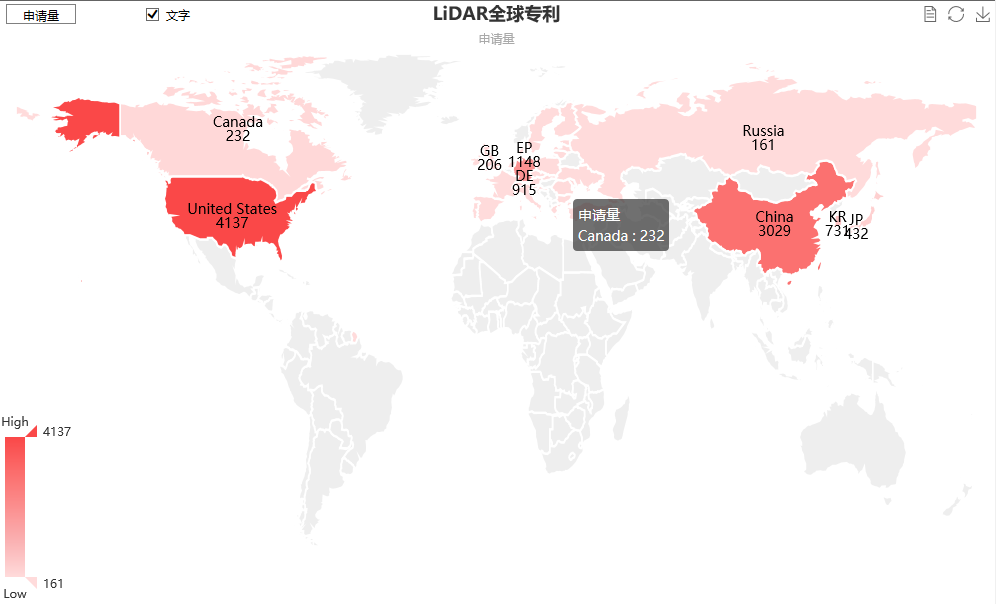

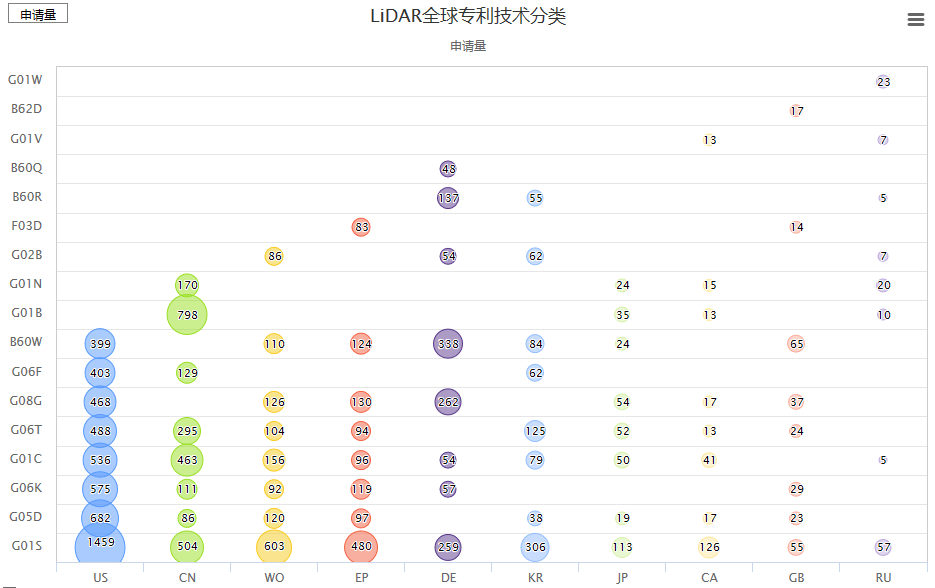

From the perspective of the number of patent applications and the distribution of patented technology categories in the entire lidar industry, the United States is in the leading position, China is behind, and China and the United States are in the first echelon. The compound annual growth rate of global lidar patent applications has exceeded 20% in the past two years.

(Global lidar patent distribution map)

(Global lidar patent technology classification map)

The high investment and long-term characteristics of lidar patent research and development are the primary problems that lidar practitioners need to face, but this is also the primary condition for them to establish core competition barriers in the industry. With the standardization of intellectual property protection awareness and the strengthening of patent awareness, for domestic lidar companies seeking to expand in the international market, patent protection is the premise to eliminate their worries, but excellent patent quality is the key to winning the market.

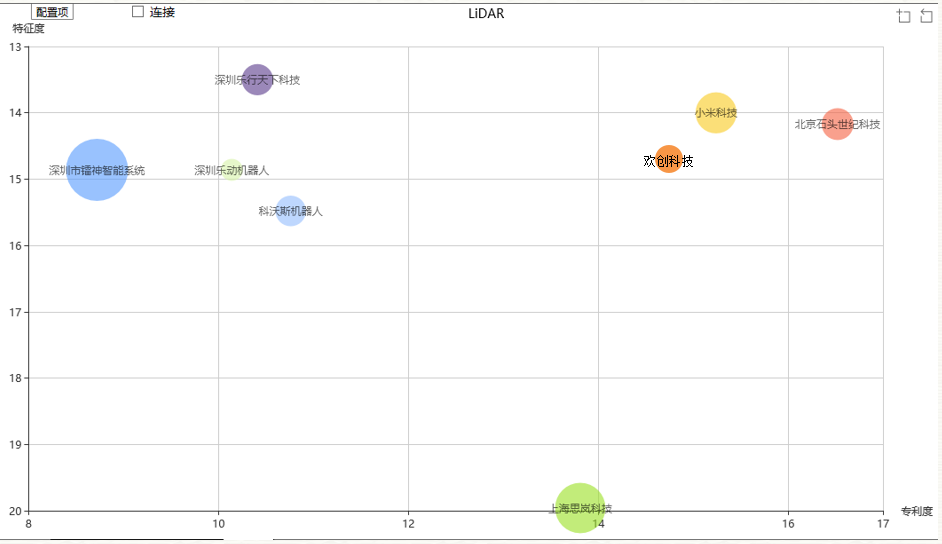

(Comparison of patent quality of major domestic manufacturers)

(PS: characteristic degree: the less characteristic degree of a claim, the greater the protection scope and the better the quality; the patent degree: the number of claims, in general, the more the number of claims, the better the quality of the patent. The more stable, the higher the quality.)

It is not difficult to see that Xiaomi, Camsense, and Roborock have relatively high features and patents, and they are in the same echelon—the quality of patents is high.

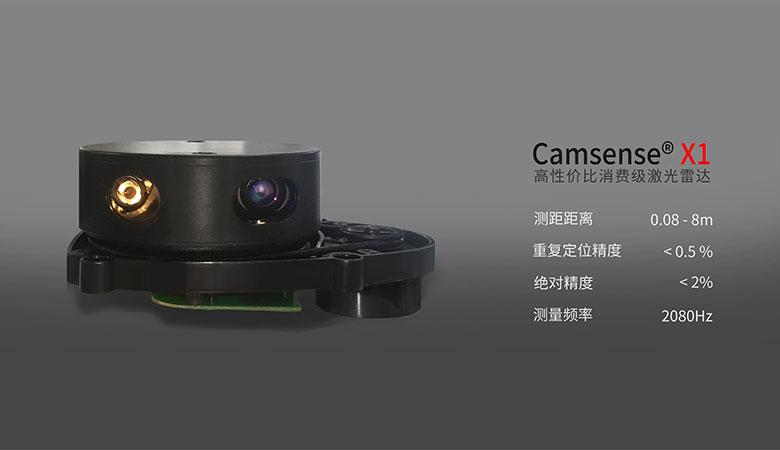

Compared with Xiaomi and Roborock, Camsense is a visual sensor company founded in 2014, but after years of patent technology precipitation, its performance is no less than that of leading companies. It is reported that Camsense has applied for 32 patents, and invention patents account for more than 68.5%. In the field of lidar, Camsense has applied for more than ten high-value patents, which are deployed in 4 countries and regions in China, Europe, and Japan. It is worth mentioning that its original area array lidar sensor + dedicated ASIC chip adopts the industry's original area array partitioned image processing algorithm to adaptively divide an area array area into multiple different linear photosensitive areas. In the sub-area, the vertical field of view of the area array consumer-grade sensor can reach 30-40 degrees, and the frame rate can reach more than 2000Hz. It is no longer restricted to the expensive linear lidar sensor, which can save 40% of the cost for downstream customers.

The advent of Camsense's new area-array lidar sensor shows that it is trapped in the situation protected by the Velodyne patent. The best way for domestic lidar companies to fight back is innovation.